Venture investors see potential in observability software — i.e. software that gives teams the ability to monitor, measure and understand the state of a system or app. And that’s not surprising. The observability market is forecasted to reach $2 billion by 2026, climbing from $278 million in 2022, according to 650 Group.

The growth is perhaps because of the software’s perceived benefits. A 2022 survey from Enterprise Strategy Group found that advanced observability deployments can cut downtime costs by 90%, keeping costs down to $2.5 million annually versus $23.8 million for observability “beginners.”

In any case, vendors like Observe are riding high.

Observe, which develops software-as-a-service observability tools for storing, managing and analyzing machine-generated data and logs, has raised $50 million in convertible debt (i.e. debt that converts to equity) led by Sutter Hill Ventures. The financing will be used to grow Observe’s sales and R&D teams, according to CEO Jeremy Burton, as the company looks to expand its headcount from 150 employees to 250 by the end of 2024.

Burton says that the decision to opt for debt funding was in the interest of deferring dilution.

“We expect to raise the Series B early next year, at which time the debt will convert to equity,” Burton told TechCrunch in an email interview. “We’ve run the company off of debt financing for the past three years.”

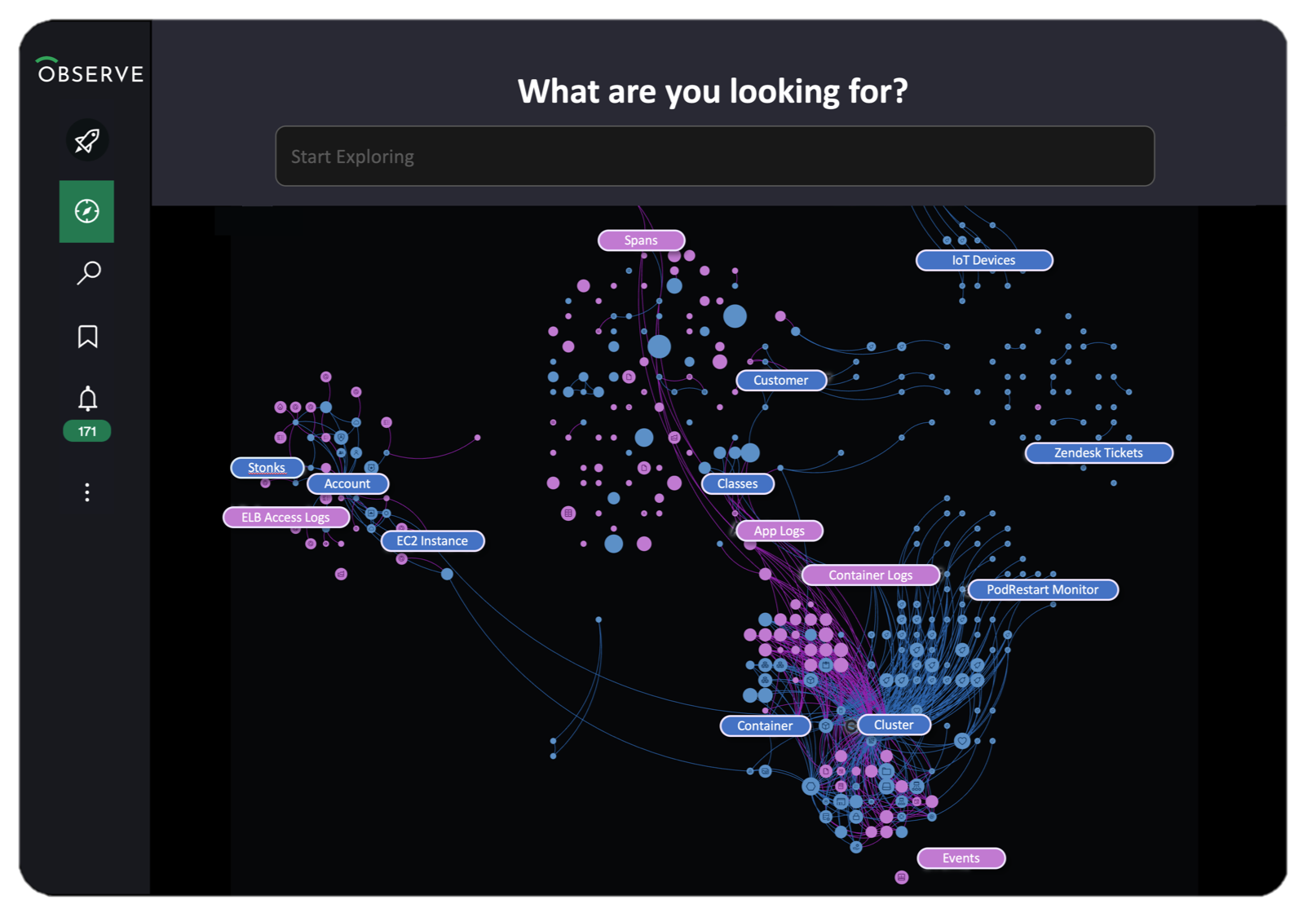

San Mateo-based Observe, which was founded in 2017 by Jacob Leverich, Jon Watte, Jonathan Trevor and Philipp Unterbrunner, stores all raw observability data in a data lake, a centralized repository. It curates and layers analytics on top of this data through what Burton calls a “data graph,” ostensibly making it easier for users to navigate and understand the data.

Observe competes with app monitoring software; monitoring and log analytics tools like New Relic, Splunk, Datadog and Sumo Logic; and new entrants to the observability space such as Grafana, Chronosphere and Honeycomb. But it’s launching new tools and capabilities to stay ahead of the curve.

Burton claims that Observe is now capable of ingesting over a petabyte of data per day into a single customer’s instance while providing a “live” mode for interactive debugging. And, as of this week, Observe offers a range of generative AI features designed to expedite specific observability tasks.

For example, Observe’s new GPT Help module, basically a chatbot, responds to natural language commands about Observe’s features, “how-to” tasks and error messages. Meanwhile, GPT Extract parses data to add structure to logs on the fly. GPT Slack Assistant embeds into Slack to help users troubleshoot issues and summarize threads for incident response. And OPAL Co-Pilot generates Opal code — Observe’s query language — in response to natural language inputs.

Now, do organizations investing in observability want all this trendy generative AI stuff? It’s possible. Burton seems to think so, for what it’s worth.

“As organizations become increasingly digital, the volume of telemetry data generated by modern distributed applications is exploding,” Burton said. “Legacy tools weren’t designed for either the volume of data or the complexity of investigating unknown problems in production … But since its founding, Observe has viewed observability as a data problem — if data used to troubleshoot could be stored in one place and reasoned about in a single tool, users would be able to solve problems much faster.”

Generative AI isn’t all that’s new in Observe’s platform. The company’s introducing Observe Apps, prebuilt packages containing Observe configurations and best practices for observing specific dev environments. And Observe’s launching a public API and command line interface, alongside options to export data to a CSV file or a Snowflake dashboard for further analysis.

Burton admits that the economic downturn and pandemic forced Observe to shift its go-to-market approach, with an increased focus on companies with 200 to 2,000 employees. But he claims that this led to success in the end, bringing Observe’s client base to over 60 brands and around 1,600 monthly average users.

“Over the past year, we’ve moved the sales team up to larger accounts and that has resulted in much higher average sales prices and less churn,” Burton said. “While we’re not disclosing annual recurring revenue at this time, what we can share is that Observe has already surpassed its new annual contract value plan for 2023.”

Will generative AI and a platform refresh take Observe to new heights? Perhaps. Or maybe it’ll simply enable Observe to stay a disciplined, measured-growth course, which isn’t necessarily a bad thing.