The tokenization market has expanded rapidly, offering diverse platforms and services. However, not all tokenization providers are created equal. From tech-only solutions to fully licensed platforms, each model has unique strengths and limitations.

Drawing from the expertise shared by InvestaX CEO Julian Kwan in the RWA Tokenization Masterclass, this blog provides an insightful breakdown of the three major types of tokenization service providers and why InvestaX leads the way with a Licensed Tokenization SaaS Platform that combines tokenization technology and licenses.

TL;DR - The tokenization market is crowded with different service providers:

- Tech-only providers: Without licenses like broker-dealer or custody approvals, tech-only platforms cannot facilitate compliant fundraising or trading.

- Exchange-only providers bring licensing but limit flexibility and ecosystem access, also there is no support or funding on primary issuance.

- Licensed Tokenization Software-as-a-Service (SaaS) platform: The most cost effective comprehensive model, blending tokenization infrastructure with regulatory compliance, offering the only one-stop shop.

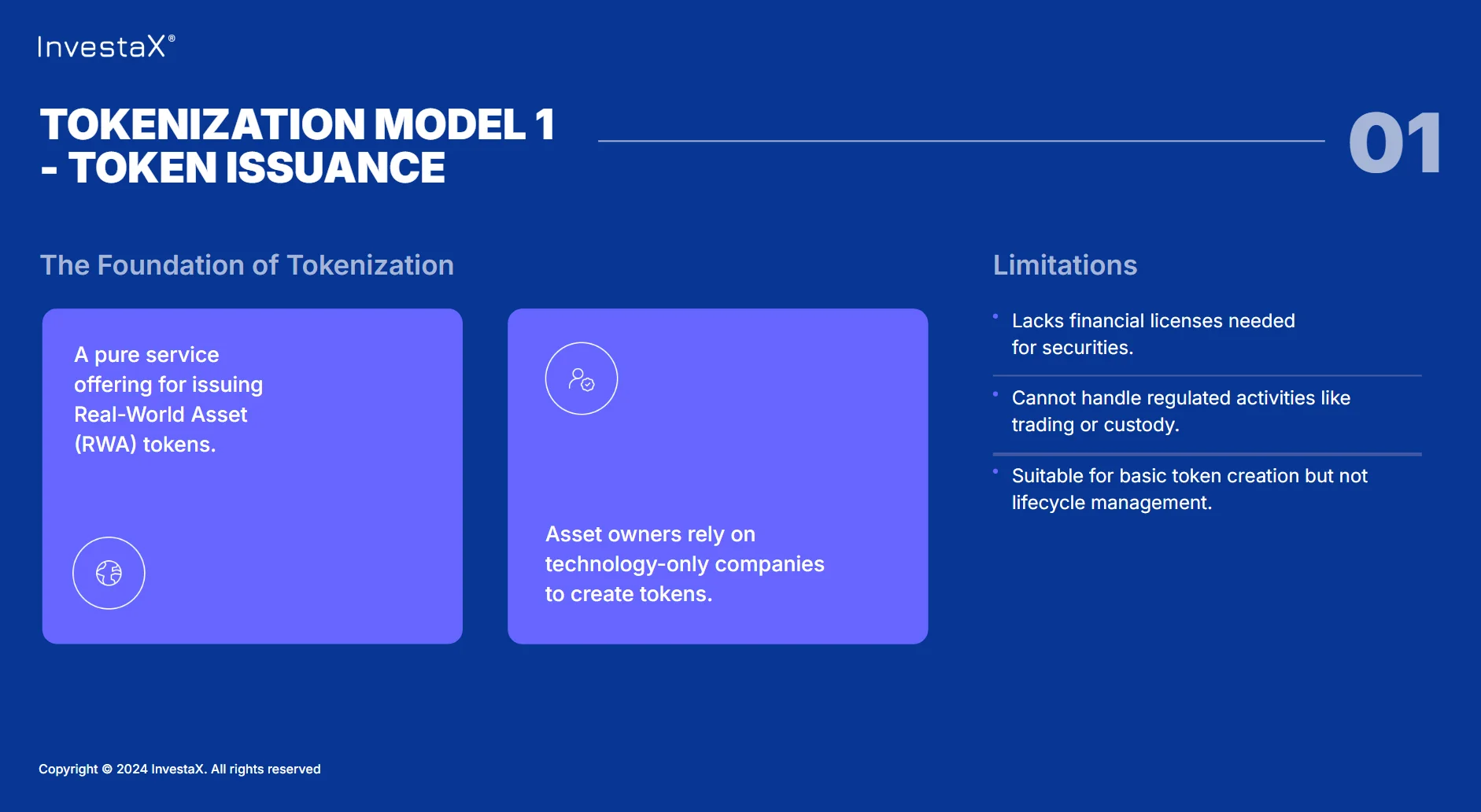

1. Tech-Only Providers: Affordable but Incomplete

Tech-only providers specialize in delivering the core technology needed to tokenize assets. These platforms can be cost-effective and ideal for businesses exploring initial tokenization efforts, such as proofs of concept or pilot projects. However, they may not include the licensing and compliance infrastructure required for regulated Real World Asset (RWA) offerings.

Challenges:

- Regulatory Gaps: Without the necessary broker-dealer, custody, or securities exchange licenses, these providers cannot facilitate compliant fundraising or secondary trading.

- Limited Ecosystem Support: These platforms often leave asset owners to manage critical processes like investor onboarding, custody, and trading independently.

- Scalability Issues: Most tech-only solutions are suitable for proof-of-concept projects but fall short when applied to large-scale, real-world use cases.

Julian commented: “Token issuance is only one part of the broader process. This model can work for issuing RWA tokens to yourself or a small pool of existing investors. However, real-world equity tokens are classified as securities and therefore require comprehensive solutions, including proper licensing, securities servicing, market access, custody, and more.”

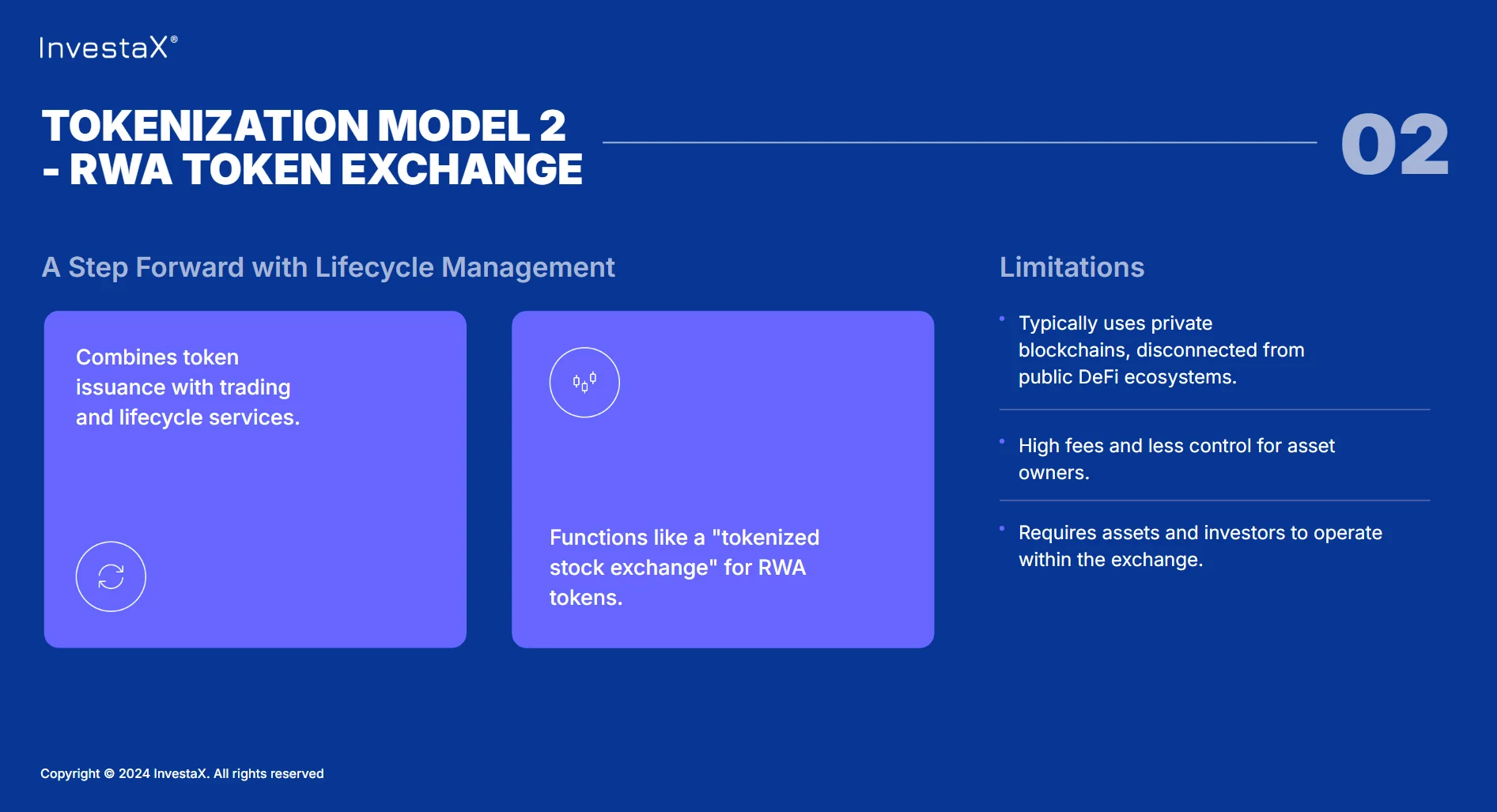

2. Exchange-Only Providers: Licensed but Rigid

Exchange-only providers often specialize in facilitating primary issuance and secondary trading of tokenized assets. These platforms often hold the necessary licenses to operate in regulated markets, making them a reliable choice for enabling compliant asset trading.

However, many security token exchanges are built on private blockchains and are disconnected from the entire digital asset ecosystem, which is critical for a seamless end-to-end tokenization process.

Challenges:

- Disconnected Infrastructure: Many exchanges built on their own private blockchains, lack the tools to support primary issuance, leaving issuers to handle funding and structuring separately.

- Dependency on Market Conditions: Without integrated services like market makers or liquidity pools, these platforms struggle to support robust trading ecosystems.

- Protocol Limitations: Some exchanges use private blockchains or proprietary protocols, reducing interoperability and market appeal.

- Lack of Market Makers

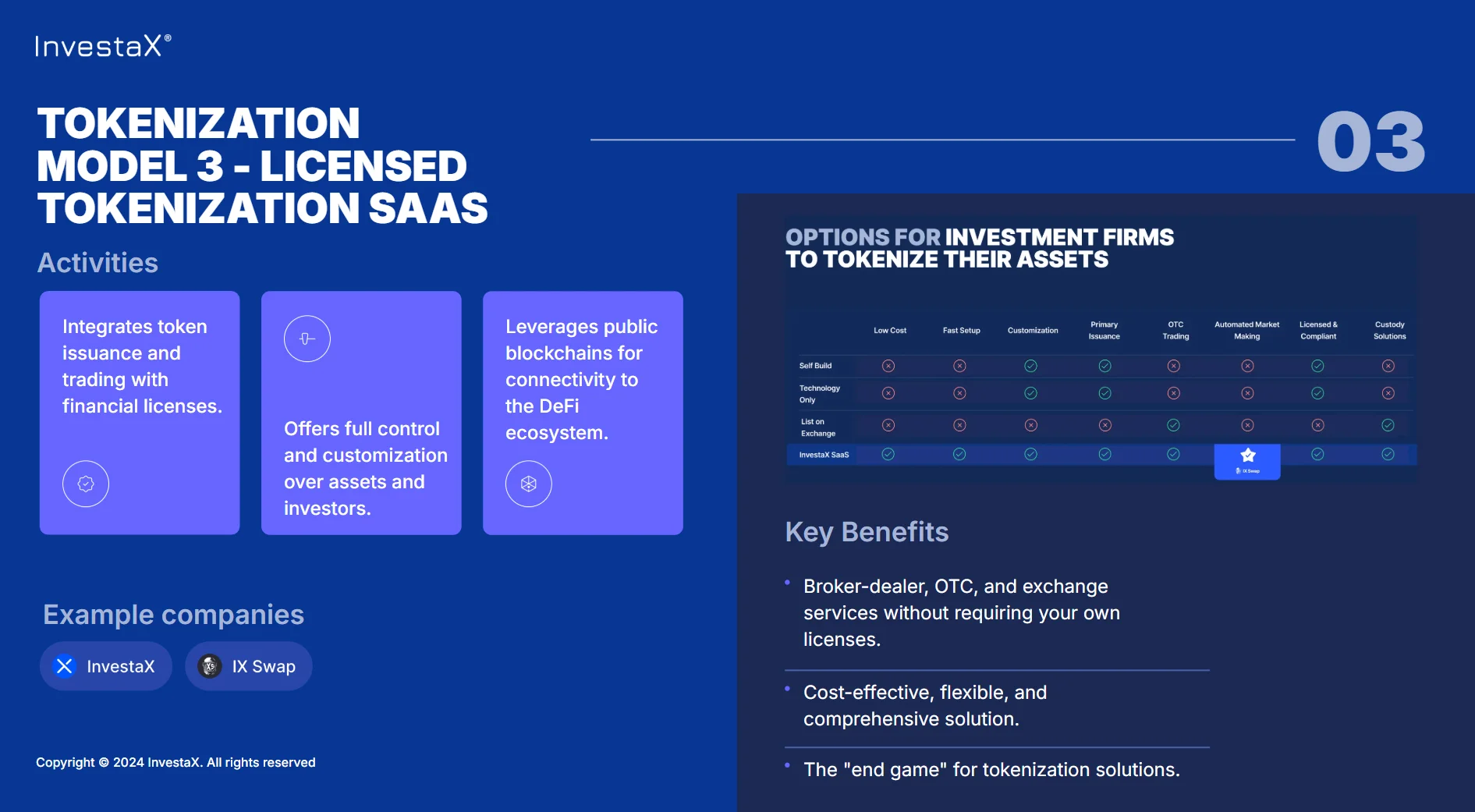

3. Licensed Tokenization Platforms: Comprehensive and Flexible

The third and most advanced model integrates tokenization technology with the required licenses for compliant RWA offerings for the entire asset life cycle. This approach ensures seamless and compliant issuance, investor onboarding, custody, and secondary trading within a single platform.

Advantages:

- End-to-End Solutions: From primary issuance to custody and trading, licensed tokenization platforms provide a complete ecosystem for RWAs.

- Regulatory Compliance: By holding broker-dealer licenses and exchange approvals, these platforms ensure that every transaction is secure and legally compliant.

- Ecosystem Integration: These platforms often include features like KYC/AML compliance, market-making tools, and custody solutions, creating a streamlined experience for issuers and investors.

Example companies:

- InvestaX: Tokenization SaaS platform licensed by the Monetary Authority of Singapore (MAS) for the issuance and trading of RWA tokens.

- IX Swap: Tokenization SaaS platform licensed by The Bahamas for the issuance and trading of RWA tokens.

Why Does InvestaX Lead This Superior Model?

As Asia’s first licensed tokenization platform, InvestaX combines cutting-edge technology with regulatory compliance to deliver a superior solution. The platform allows users to co-brand sections, tokenize assets, onboard investors with KYC/AML compliance, and manage liquidity pools—all underpinned by robust licenses.

“Our model is superior and offers the fastest, lowest cost, and one-stop-shop solution. It’s designed to scale, enabling clients to tokenize assets, onboard legitimate investors, and trade securely on public blockchains. This isn’t just a service—it’s an infrastructure for the future of finance,” - Julian added.

As the tokenization market evolves, licensed platforms like InvestaX are uniquely positioned to address the full spectrum of challenges associated with issuing, managing, and trading tokenized RWAs. By aligning cutting-edge technology with compliance, InvestaX sets a benchmark for security, flexibility, and scalability in tokenization.

For RWA tokenization, public protocols are used as an essential technology layer to issue the RWA tokens, but that is all they do. If we consider RWA tokens are mostly securities, the protocols need to be integrated into licensed broker dealers, exchanges and custodians to deliver the necessary issuance and trading of the RWA tokens. KYC/AML, primary issuance, secondary trading, custody etc are all licensed activities.

A protocol claiming they are all that is needed to issue and trade RWA tokens is analogous to the paper company claiming all you need to sell shares in a company or a sell your house is the paper they sold you to write the contract on.

The confusion may lie in the fact that decentralized apps (DApps) can be built on any public protocol without the need for any discussion or 3rd parties involved, that is the DNA of blockchains and DApps. With real world assets, you need a whole set of service providers to legally and compliantly issue the RWA tokens, and the protocol is just the underlying layer, important but far away from the most critical components.

Explore the Full Session

This insight is part of the RWA Tokenization Masterclass by our CEO and Co-Founder Julian Kwan. Watch the full masterclass recording here.

Conclusion: Choose the Right Tokenization Partner

When entering the tokenization market, it’s critical to align with a platform that understands both the technological and regulatory complexities of RWA tokenization. InvestaX stands out as a leader in the licensed tokenization platform model, offering clients the tools and infrastructure to navigate this transformative industry.

Contact us to start your tokenization journey today!