Tokenization is transforming how real-world assets (RWAs) like equity, real estate, and private debt are issued, traded, and managed. However, this innovation must align with robust regulatory frameworks to protect investors and ensure compliance.

With insights from Julian Kwan, CEO of InvestaX, and our Legal & Compliance team, we break down the four key stages of asset tokenization, highlighting the critical licenses and regulatory requirements for each phase.

The Four Major Stages of Tokenization and What Licenses Are Needed?

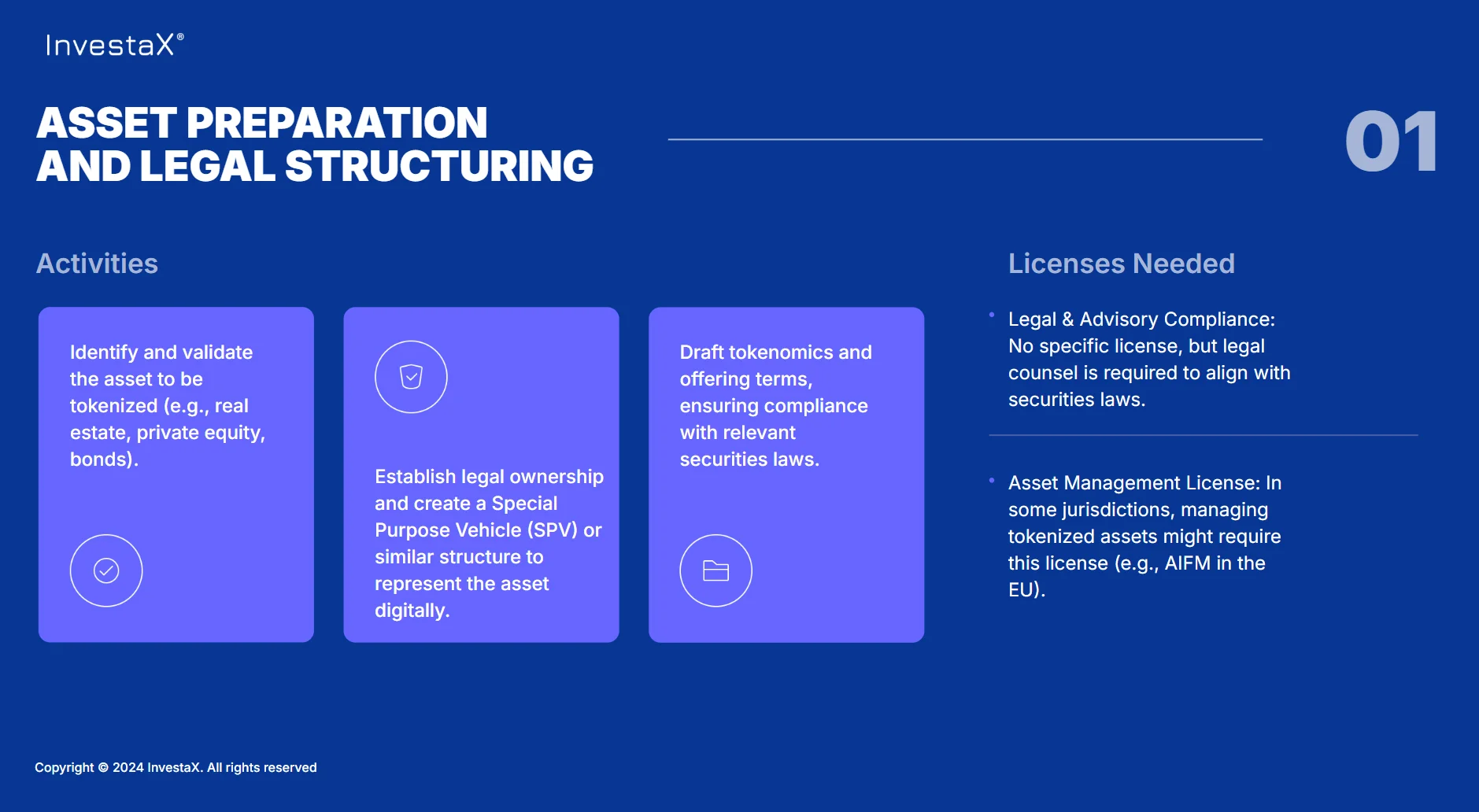

1. Asset Preparation and Legal Structuring

Tokenization begins with preparing the asset for tokenization and ensuring its legal compliance. This involves creating a solid legal foundation to protect both investors and issuers.

Key Activities

- Establishing the legal entity for the asset (e.g., real estate fund, equity, or debt).

- Drafting contracts that align with traditional legal standards and smart contract capabilities.

- Verifying that asset managers have the appropriate licenses for managing specific asset types.

Regulatory Requirements

Asset owners and fund managers must confirm that their activities align with existing regulations. For example:

- Fund Manager Licenses: If tokenizing a real estate fund, the manager may require a license to manage collective investments in real estate.

- Securities Compliance: If the token represents equity or debt, it must adhere to securities laws, including registration or exemption filings.

“Tokenization doesn’t replace the legal foundation of an asset—it modernizes it,” explains Julian. “It’s about improving infrastructure while maintaining the same legal rigor as traditional investment vehicles.”

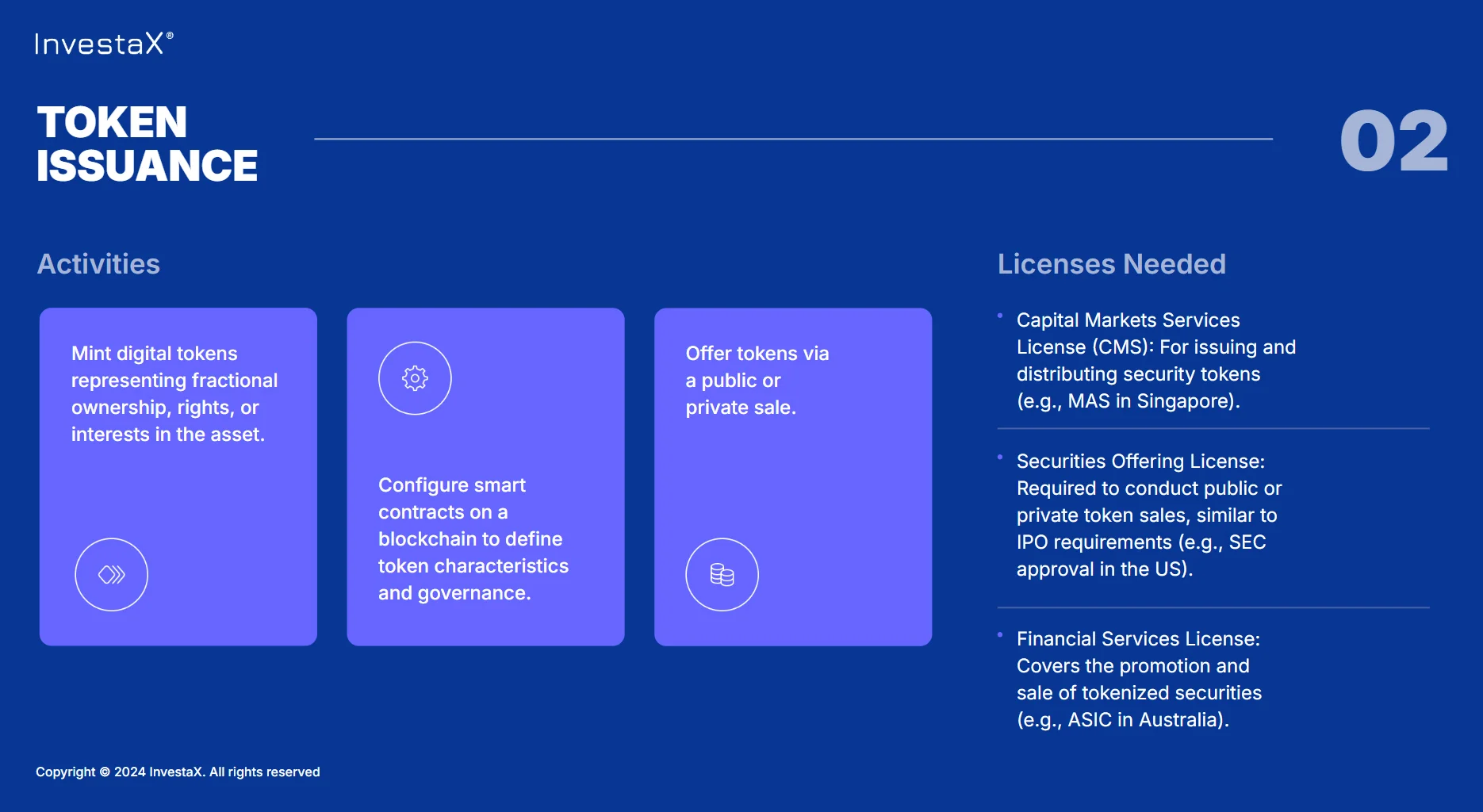

2. Token Issuance

The next stage involves minting tokens that represent ownership, debt claims, or another form of entitlement to the underlying asset. This process must align with both technological and regulatory requirements.

Key Activities:

- Selecting the appropriate token standard, such as ERC-20 or ERC-1400, depending on the asset type and regulatory needs.

- Building smart contracts that incorporate compliance features while automating transactional processes.

- Disclosing all investment metrics, such as expected returns, risks, and terms.

Regulatory Requirements

Regulators often require issuers to follow strict guidelines for token issuance, including:

- Token Standards: Adopting standards like ERC-1400 ensures regulatory features such as identity checks and compliance baked into the token.

- Licenses for Issuers: Some jurisdictions require specific licenses for platforms issuing tokenized securities or assets.

- Regulatory Disclosures: Just as with traditional securities, detailed prospectuses or offering documents may be required.

“Token issuance is not just about the technology; it’s a regulatory process,” Julian emphasizes. “The smart contract must be as legally enforceable as the paper contract it complements.”

3. Investor Onboarding and KYC Compliance

Ensuring that investors are verified and eligible to participate in the tokenized offering is a critical step that protects both issuers and investors from potential risks.

Key Activities:

- Conducting Know Your Customer (KYC) and Anti-Money Laundering (AML) checks.

- Verifying investor eligibility based on classification (e.g., accredited vs. retail investors).

- Providing clear documentation outlining investor rights and responsibilities.

Regulatory Requirements

Compliance at this stage is critical:

- AML/KYC Requirements: Platforms must verify investor identities and screen against sanction lists to comply with local and international AML regulations.

- Accreditation Rules: Many jurisdictions require that certain offerings be limited to accredited investors, necessitating documentation to prove eligibility.

“Modern tokenization platforms have streamlined KYC to the point where it’s as seamless as onboarding with top cryptocurrency exchanges,” says Julian. “This step isn’t a burden—it’s a safeguard for both issuers and investors.”

4. Token Custody and Management

After issuance, the focus shifts to securing tokens and managing the underlying asset effectively. This stage bridges the digital representation of ownership with real-world operations.

Key Activities:

- Offering secure custody solutions, whether through self-custody wallets or licensed third-party custodians.

- Facilitating secondary trading through compliant venues with market makers or Automated Market Makers (AMMs).

- Managing the underlying asset, such as maintaining real estate properties or executing business strategies.

Regulatory Requirements

- Custody Requirements: Licensed custodians are often required to handle tokenized securities to provide investor protection and regulatory oversight.

- Secondary Trading Licenses: For platforms enabling token trading, licenses such as broker-dealer or securities exchange licenses are essential.

- Asset Management Compliance: Managers must maintain any required operational licenses to oversee the performance of the tokenized asset.

“Tokenization doesn’t change the fundamentals of managing the asset itself,” explains Julian. “A real estate manager still needs to build and maintain properties; what changes is the infrastructure used for issuing and trading ownership in those assets.”

Explore the Full Session

This insight is part of the RWA Tokenization Masterclass by our CEO and Co-Founder Julian Kwan. Watch the full masterclass recording below.

Final Thoughts

Tokenization represents a powerful opportunity to modernize financial infrastructure, but its success depends on meticulous alignment with regulatory requirements. From asset preparation to custody, compliance ensures a secure, transparent, and scalable system for all stakeholders.

“Innovation in finance isn’t just about technology,” Julian concludes. “It’s about trust, compliance, and building a sustainable future for all stakeholders.”

Launch Your First RWA Token with InvestaX

InvestaX is the leading Tokenization SaaS Platform in Asia, licensed by the Monetary Authority of Singapore (MAS) and holds a Capital Markets Services (CMS) Licence and Recognized Market Operator (RMO) License for the issuance and trading of RWA tokens for global investors.

Looking to tokenize your assets? Contact our team to discuss your tokenization strategy.